The manufacturing sector remains a significant player to Singapore’s economy, as it contributes some 20 to 25 percent of Singapore’s annual gross domestic product (GDP). Singapore is the sixth-largest global exporter of high-tech products. Singapore’s manufacturing production grew 13.8 percent in May 2022 on a year-on-year basis, data released on Friday (24 June 2022) by the Economic Development Board (EDB) indicated.

In the past year, the Singapore Government has directed the manufacturing industry towards the main focus on advanced manufacturing development. As robotics, artificial intelligence, 3D printing, smart sensor and the Internet of Things (IoT) are transforming the manufacturing sector, advanced manufacturing is a burgeoning market expected to reach US$156.6 billion by 2024, growing at a rate of 16.9 percent a year.

Under the manufacturing sector, a growing and vibrant electronics industry underpins Singapore’s economic growth, and contributes 8 percent to Singapore’s GDP.

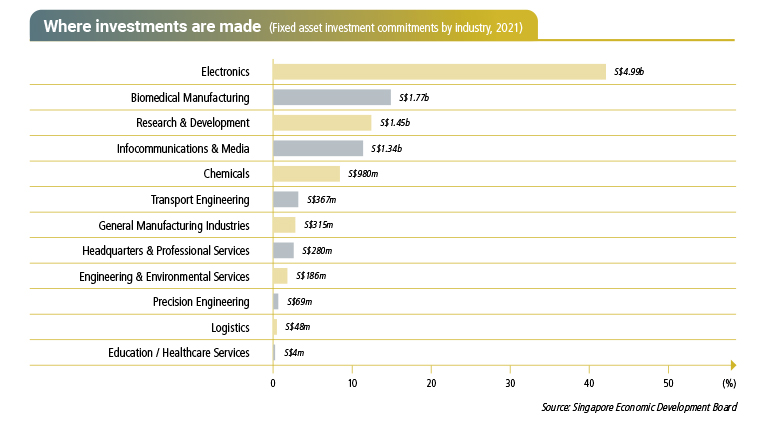

On February 2022, Singapore Economic Development Board (EDB) reported that they were able to attract S$11.8 billion in fixed asset investments (FAI) in 2021, which is above their medium- to long-term targets of S$8 million to S$10 million. The investments are expected to create 17,376 new jobs in the coming years with a projected contribution of S$16.8 billion in Value-Added Per Annum, the EDB said.

Of S$11.8 billion FAI commitments in 2021, electronics accounted for more than 42 percent of the total investments, valued at S$5 billion. The investments were largely driven by manufacturing projects in the electronics industry from semiconductor and biotech firms.

Employment for the electronics industry in 2021 stands at 74,228, which is 21 percent of total manufacturing jobs. In addition, the manufacturing of finished electronics products creates many spin-offs to other segments of the economy, such as precision component manufacturers, chemicals and materials suppliers, electronic manufacturing systems companies and logistics service providers.

Manufacturing 2030

Early last year, the then Minister for Trade and Industry Mr Chan Chun Sing announced the government’s 10-year “Manufacturing 2030” plan, to grow Singapore’s manufacturing sector by 50 percent of its current value - S$106 billion – while maintaining its share of about 20 percent of GDP.

While speaking to the media after his visit to a precision engineering company Univac on 25 January 2021, Mr Chan said the pandemic had underscored the importance of the sector to Singapore’s economy. “In a Covid and a post-Covid world, having a more diversified economy is important for us,” he said.

Mr Chan noted that the performance of the biomedical electronics and precision engineering sub-sectors were bright spots at the height of the pandemic due to increased demand for such products.

“It will also become increasingly important for Singapore to have unique capabilities and products that cannot be found elsewhere,” he added.

“In the fight against Covid-19, securing essential supplies sometimes became a barter trade, and may continue to be so as we see global supply chains continue to be disrupted,” he said.

Mr Chan noted the 2030 goal will require the sector to grow by around 50 percent in the next decade. This is at the same pace of growth as the last 10 years, an ambitious target, considering that it will become harder to use foreign labour to supplement the Singaporean workforce. The manufacturing workforce will continue to make up around 12 to 15 percent of the total Singapore workforce, but with higher-skilled roles.

For the manufacturing sector to achieve the 2030 goal, it will have to develop its competitiveness through its ability to innovate quickly and produce higher-value products, and not through lowering the cost of production or labour.

The Government outlined a three-pronged strategy:

First, Singapore will continue to attract the best global and local companies in niche areas that will help the nation remain a critical node in global value chains. Singapore is a key manufacturing location for some of the biggest semi-conductor companies globally, such as Micron and Infineon. Both examples have the most advanced factories in the world, and they’re found on Singapore soil. Mr Chan added that having two of them in Singapore is good news, but Singapore will aspire to do much better to put many more of its companies in the same league as these frontier companies.

Second, Singapore will ramp up its efforts to grow the size and capabilities of local enterprises in advanced manufacturing to create better job opportunities for Singaporeans. Tailored support will be offered to promising enterprises through programmes such as Scale-Up SG, an 18-months programme that helps selected high-growth local companies expand. The programme aims to accelerate the companies’ growth so that they will be able to contribute significantly to Singapore’s economy and create good jobs for Singaporeans. Local companies will also be able to collaborate with leading manufacturing companies through the Global Innovation Alliance (GIA), a network of Singapore and overseas partners in major innovation hubs and key demand markets, with a focus on technology and innovation. The joint initiative between Enterprise Singapore and EDB, partners in-market players across GIA cities will run inbound and outbound GIA Acceleration Programmes to connect companies to overseas business and tech communities. The GIA Acceleration Programmes support Singapore startups and SMEs in venturing abroad. They also help International startups in scaling up in Asia through Singapore as a springboard.

Third, the Government will work with polytechnics and universities to make engineering and manufacturing attractive to students. “Manufacturing is no longer about repetitive tasks done in a structured environment. In fact, today, the biggest challenge for the engineering and advanced manufacturing sector is how fast we are able to innovate and prototype new products and services,” Mr Chan said.

Singapore Economy 2030

On 4 March 2022, Singaporean Minister for Trade and Industry Gan Kim Yong unveiled a new plan to strengthen local businesses in various sectors, with an aim to significantly grow the city-state’s trade volumes by 2030. In greater detail, Mr Gan noted the plan will be driven by separate strategies that will provide direction and coordinate actions across the four key pillars of the economy – manufacturing, trade, services and enterprises.

The Singapore Economy 2030 vision for manufacturing, trade, services and enterprises will put Singapore’s industries, enterprises, and workers on a firmer footing for long-term, sustainable growth over the next decade.

On the manufacturing front, the master plan lays out new initiatives under Singapore’s Manufacturing 2030 strategy announced in 2021, which aims to grow manufacturing value-add by 50 percent. Support measures will include “bespoke support for manufacturers with strong potential, to deepen their capabilities and expand their global reach”.

Mr Gan also spoke on the need to develop a strong local pipeline of talent and ensure that Singaporeans can access good jobs in the sector. To do so, companies will have to offer attractive career progression pathways in line with technological changes, and ensure these prospects are accessible.

To develop human capital for the manufacturing sector, M2030 Careers Initiative was launched on 4 March 2022, to train polytechnic and Institute of Technical Education (ITE) graduates.

The initiative will see collaboration among companies, polytechnics, and technical institutes to identify young graduates in engineering or technical education with relevant skills to the industry.

This includes the development of a handbook for employers, covering a range of best practices and resources to help manufacturers develop structured career progression pathways for their employees.

The Singapore Precision Engineering and Technology Association, which is developing the handbook with industry partners and the institutes of higher learning, will identify and work with at least 20 companies to pilot the adoption of these practices and pathways.

The initiative will offer at least 200 internships for ITE students from 60 companies by the end of 2022, as well as a pilot grant to hire ITE graduates for critical technician and assistant engineer roles.

In addition, an Accelerated Pathways for Technicians and Assistant Engineers (Manufacturing) Grant will be piloted with selected companies.

This, according to Mr Gan, will support companies in hiring and training ITE graduates for critical technician and assistant engineer roles through on-the-job training, with career progression and competitive salaries.

Apart from manufacturing, the other pillars are trade, services and enterprises.

On trade, the Ministry of Trade and Industry (MTI) intends to raise Singapore’s export value from S$805 billion in 2020 to at least S$1 trillion by 2030.

The Republic also wants to double its offshore trade value to US$2 trillion (about S$2.7 trillion) over the same period, while capturing more re-exports and transhipment flows to embed Singapore more deeply into the global supply chains.

“Given our small domestic market, global connectivity is essential to help our enterprises grow beyond our borders,” Gan said of the strategy’s trade ambitions.

To achieve this Trade 2030 strategy, Singapore will work on building a strong ecosystem of trading companies and activities by attracting leading global traders to anchor more of their upstream, downstream and innovation activities here in Singapore.

These traders will also serve as platforms to help other Singapore firms to break into overseas markets, the minister said.

More efforts will also go into growing a strong core of local traders “that command global scale and are highly innovative.”

Mr Gan noted that Enterprise Singapore will tap on its programme offerings, such as Scale-Up SG, that helps selected high-growth local companies expand; and the Enterprise Leadership for Transformation Programme (ELT), a one-year programme that supports business leaders of promising small and medium enterprises to develop business growth capabilities. The support is tailored to each firm’s circumstances and ambitions and will cover areas such as talent development, innovation, internationalisation and financing.

Growing Singapore’s trading volume will create “good jobs” for Singaporeans, said Mr Gan, noting that the trading sector employed more than 300,000 people in 2020. Of which, the majority were locals and close to 70 percent were PMET jobs.

As the trade sector continues to grow, the country must build a workforce with the necessary skills and knowledge, he added.

On top of a Jobs Transformation Map and other sector-specific workforce upgrading initiatives that are already under way, authorities are also working with the industry and institutes of higher learning to develop more talent in the trading of commodities such as liquified natural gas and carbon credits.

For the services sector, which represents more than 70 percent of Singapore’s economy, Mr Gan pointed out the need to develop new engines of growth and highlighted two “major waves of opportunities” – sustainability and digitalisation.

The Singapore Economy 2030 vision will also need to be supported by a vibrant ecosystem of local enterprises that are future-ready, globally competitive and possess deep innovative capabilities.

These enterprises will in turn create good jobs and meaningful careers for Singaporeans.

Likewise, the country will embark on an Enterprise 2030 strategy to “scale up efforts to identify and support promising local businesses.”

Continued strong growth of the semiconductor industr

At the Singapore Semiconductor Industry Association (SSIA) Semiconductor Business Connect 2022, held on 19 May, MOS Alvin Tan highlighted that continued strong growth of the semiconductor industry can be seen both globally and locally, fuelled by new tech applications like 5G, AI, cloud computing, the Internet of Things (IoT), and a strong demand for consumer electronics and digital services during the pandemic.

Despite shorter-term risks of disruptions to supplies of raw materials and equipment due to the conflict in Ukraine and lockdowns in China, the overall outlook for the semiconductor industry is very positive – the global market for semiconductors is projected to continue growing to reach US$1 trillion over the next decade, which is more than double the size of the semiconductor market in 2021.

In Singapore, semiconductor manufacturing contributes more than 80 percent of the electronics manufacturing output and 7 percent of the nation’s GDP. Semiconductor continues to be the fastest growing segment of the electronics industry, with output projected to increase 30 percent year-on-year in 2021.

Today, Singapore accounts for 11 percent of the global semiconductor market. Some 20 percent of global semiconductor equipment is manufactured in Singapore. Singapore’s semiconductor industry is poised for further growth, with around 2,000 more jobs expected to be created in the next 3 to 5 years.

As part of Singapore’s Manufacturing 2030 vision to become a global business, innovation, and talent hub for advanced manufacturing, Singapore aims to anchor frontier investments from global companies with specialised capabilities to support its local manufacturing ecosystem.

Singapore has recently attracted investments from leading global semiconductor companies such as GlobalFoundries, Siltronic, and UMC. These companies invest here because of skilled talent, excellent global connectivity, ease of doing business, and well-developed semiconductor research and manufacturing ecosystem. In turn, they further drive the growth of the semiconductor industry and contribute greatly to Singapore’s R&D ecosystem with high value activities.

Over the years, Singapore has also been building its capabilities and capacity in the electronics and semiconductor industry to strengthen its role in the global supply chain.

JTC has developed four Wafer Fab Parks (WFPs) to meet the specific needs of the industry. The WFPs will be rolling out a series of physical enhancements, such as new lifestyle amenities, to create a more vibrant and conducive environment for companies and their employees.

In addition, JTC is also building semiconSpace in Tampines Wafer Fab Park, which is a new plug-and-play development that will meet the stringent requirements of semiconductor companies, such as vibration-sensitive flooring. The first phase is targeted to be completed by this year.

The Government will continue to work with key industry partners and schools to attract more locals to join the manufacturing sector. Mr Alvin Tan said, “We will also ensure that our workers have the right skills to benefit from the opportunities in this sector.”

Another major priority in the efforts to grow the semiconductor industry is sustainability. The semiconductor industry plays a critical role in Singapore’s green transformation. Information and computing technology are projected to consume up to 20 percent of gl

Another major priority in the efforts to grow the semiconductor industry is sustainability. The semiconductor industry plays a critical role in Singapore’s green transformation. Information and computing technology are projected to consume up to 20 percent of global energy demand by 2030, with chip manufacturing accounting for most of its carbon footprint. The industry can collectively make an impact on climate change, by making decisive and concerted actions to embrace sustainability and drive change.

The green transformation presents exciting economic opportunities for semiconductor companies. Companies that are able to reinvent themselves to harness sustainability as a competitive edge can become more efficient, reduce costs, and better meet their shareholders’ and customers’ expectations.

The Government will support companies on this journey towards more sustainable practices. “Under the Urban Solutions and Sustainability (USS) domain of our S$25 billion Research, Innovation and Enterprise 2025 (RIE2025) plan, we will support the development and commercialisation of sustainability solutions,” said Mr Tan.

“Under the Green Economy pillar of the Singapore Green Plan 2030, we aim to strengthen global and regional partners to conduct R&D in green technologies.”

To remain globally competitive and seize opportunities in the global semiconductor supply chain, companies will need to come together to explore new business opportunities, including collaborating with suppliers and partners to develop innovative solutions.